Source : BUSINESS NEWS

Perth’s industrial market has remained strong, as it continues to report one of the lowest vacancy rates in the country for the past six months.

The rate lifted from 1.2 per cent to 1.8 per cent from the first half of this year to the second, according to data released today by CBRE.

However, Perth and Adelaide’s 1.8 per cent recorded the lowest industrial vacancy rates out of the major cities.

Perth’s strength in the industrial market was also echoed in last year’s CBRE report where Perth held the lowest rate in the second half of 2024 at 1.4 per cent.

The Industrial and Logistics Vacancy Second Half 2025 report showed the national average had risen to 3.2 per cent.

All the major cities’ rates lifted except for Brisbane, which tightened slightly from 3.2 per cent to 3.1 per cent.

“Perth’s vacancy rate increased to 1.8 per cent in the half year to December 2025, up from 1.2 per cent in June 2025,” CBRE Western Australia senior director Jarrad Grierson said.

“The increased vacancy comprises a mix of some new supply, prelease backfill space and sublease accommodation.

“Tenant enquiry remains fairly subdued as tenants adjust to increased rents and broader economic uncertainty.

“Market rent growth has stabilised with recent deals indicating an increase in leasing incentives as landlords become more motivated.”

Melbourne continued report the highest vacancy in the country at 4.7 per cent.

CBRE Victoria state director Thomas Murphy attributed the upward trajectory to an ongoing imbalance between high supply levels and limited occupier demand.

“While face rents have largely held firm, incentives have edged higher across all precincts, reflecting the competitive leasing environment,” he said.

“Sublease availability remains limited across most precincts, with only the west continuing to offer a moderate amount of sublease options.

“Looking ahead, the anticipated slowdown in supply completions from 2026 is expected to provide some relief to upward vacancy pressures.

“Despite current cyclical headwinds, super-prime assets in core locations are expected to outperform in the current environment.”

Sass Jalili, the CBRE head of industrial and logistics and data centre research Australia, said the lifting of the national vacancy rate average to 3.2 per cent was still below the predicted rate of 3.5 per cent.

“Vacancy is still expected to peak in the second half of 2026, however, even at its highest point the rate is expected to remain below the market’s ‘equilibrium’ threshold of 4 per cent,” she said.

A national trend to look out for in 2026 is declining super prime availability and increased vacancy within prime and secondary assets, according to Ms Jalili.

“The superior height clearance and efficiency of super prime facilities are increasingly critical for logistics operators, Australia’s largest industrial occupier segment, which is supporting the sustained demand for these spaces,” she said.

“In the long-run, Australia’s supply of serviced, zoned industrial land is expected to remain structurally constrained, limiting new development pipelines.

“This scarcity, combined with the ongoing expansion of e-commerce and food & beverage occupiers, as well as sustained population growth, will remain key drivers of long-term growth.”

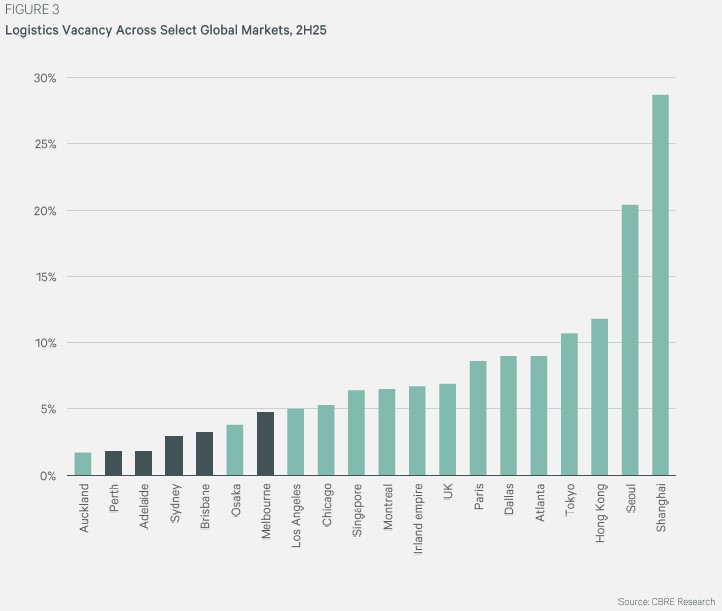

In comparison to select cities around the world, the CBRE research showed Perth still recorded some of the lowest industrial vacancy rates.